More on The Voo Doo of Merlin-Omics

By J. Mustafa Farquar CPW News Services

Milton Friedman, Ronald Reagan’s patron saint of free market

principles and the deregulation of the American business culture laid the

groundwork for the abuses of the 80’s and 90’s....particularly 1999, the years that the Glass-Steagall Act was repealed...leading to the Merlin-Omics of the GWB and Obama years. So says Dr. Frederick M.

Mellon author of The Reconciliation of Ayn Rand.

“Ayn Rand said famously ‘achievement without plunder’, but

we all know that plunder was the goal of deregulation. Uncle Milty failed to tell us how in a

culture of increasing corporate greed and avarice the Invisible Hand of the

free market didn’t become a looter of the community cookie jar. Milty was so over the top with his rejection of

the rule of law calling it instead, ‘regulation of the market’, that I’m not sure just how America could have

ever become America on the basis of the rule of law. Is the Magna Carta considered ‘regulation’? How about the regulation ending slavery and

cannibalism? Isn’t that ‘market

regulation?’ Uncle Milty, I call him that because he was

such a cute little elf, but he certainly

didn’t tell us that the monster of credit defaults and other exotic….exotic ….sounds

like some harmless little ticklish butt plug, doesn’t it?.....that these financial instruments would be used to plunder

tax payers’ hard earned dollars,” said Mellon.

Mellon believes that Joseph vs. the Moses analogy is a powerful one for understanding just what happened in 2008. Joseph was the servant of the Pharaoh. Moses was the reformer who democratized life with the delegation of authority and empowerment of all people. "You had in Robert 'Merlin' Merton combined with his work with Paul Lazarfeld the model for developing a Global-Gestalt....the propagandizing of the people through mass indoctrination and manipulation. In the post-World War II environment political and economic ideologies battled for control. Using focus groups and studies in bureaucracy, deviance, mass communication, the sociology of knowledge, insider and outsider perspectives and obliteration through incorporation Merton and Lazarfeld were able to arm the pharaohs of Wall Street with the resources they needed for control. As with other institutions like Stanford and the Stanford Research Institute, Merton and Lazarfeld's research was partially funded by the Central Intelligence Agency which has its start with the OSS or Office of Strategic Services which met initially at Rockefeller Center in New York. At Princeton, Lazarfeld had developed the Office of Radio Research and Lazarfeld's students became the presidents of CBS, NBC and ABC. In 1944, when Lazarfeld moved from Princeton to Columbia University where Merton would join him, the ORR was renamed the Bureau of Applied Social Research or BASR. In the 1950's and 60's Columbia became the leading university for social research. The fact that the father of this research was also the father of the credit-default instruments that tanked the U.S. economy has not been studied with any degree of seriousness. The fearless defender of American capitalism, Charlie Rose, missed the opportunity to probe this issue with a panel of Robert C. Merton and his mentor, Paul Samuelson before his death and their critics. Rose, after all, lives in New York and as Moses learned, to bite the hand of the Pharoah, can mean a long walk in the wilderness.

The most significant element of Lazarfeld and Merton's research was the power of collective amnesia, held not by the collective, but by its handlers. This was what was passed on with the repeal of Glass-Steagall. Moreover, it was the aim of John D. Rockefeller in his backing of the Oriental Institute in Chicago which had as its goal the reinstatement of historical research into Egyptian, Persian and Middle-Eastern Oriental philosophies and culture which Western Civilization had by-in-large rejected on its quest toward greater autonomy through the Renaissance, Enlightenment, Reformation and beyond. It was these important points of reference that new mind science and research methods influenced by Larsfeld, Merton and others sought to eliminate from inquiry just as had the mumbo jumbo of credit-default swaps and other Gordian nooses. New methods of academic research like 'grounded theory' were not grounded in anything that touched on historical evidence which Robert Lynd foresaw as the coming of research without a selective point of view or what he called the "ditty bag of an idiot". Focus groups were for the here and now and the short news cycle achieved in mass communication the tool for triggering the collective amnesia. Severed from its history by a mind science that rewarded the breakdown the population could be easily controlled. Academia recruited bright young minds that would betray themselves easily. Education became then, not the means to knowing how to think, but of what to think. Cut off from their history the population could more easily be convinced to make bricks with less straw, but also to chase an illusive 'American Dream' of building their own little pyramids on easy money with bigger bedrooms, more granite topped kitchen counters, sub-prime loans, bundled mortgages held by the big banks as jobs shipped to foreign countries without the inconvenience of the time-honored Western mindset. As Dave Ramsey yelled "freedom" from the 30 year mortgage, housewives and husbands saw their home as a piggy bank and refinanced it or sold it off for a step up to a newer bigger one while rationalizing that the feeling of freedom while liberating, was a distant second to the pain that burdened living under a new sub-prime mortgage rate injected into their routines. The majority of the local banks knew what was happening, but did nothing to reverse it for fear of the Federal Reserve and bam! Hello Hank Paulson!

"I can imagine that many of these failing local banks partnered together in what under Glass-Steagall would have been a crime, took the TARP money, then saw their stock price go up, perhaps saying like Ken Lewis that they didn't need it and gave the money back just as they were laundering it like a Chinese steam cleaner, then finding new investors jumping in with money from who knows where and life is a cabaret!" said Mellon. "The bankers see it like a surgeon sees the systolic and diastolic pumping action of the human heart. As long as its pumping in Boston or San Francisco, Chicago, New York or Houston, Dallas and Miami, who cares if the blood flows through a few backwater war-torn nations where innocents are killed in collateral damage, or as sociologist father of Robert Merton, also Robert Merton, coined....'unintended consequences'?" asked Mellon. "Unintended? Huh!" Mellon blurted.

Mellon's eyes were glazed. “Dr. Paul Samuelson’s assessment of the rape by the Frankenstein monster he had a hand in creating was not strong enough. When the Moses Tradition is jettisoned for the Joseph Tradition....forget the damn Jesus Tradition....that would take a friggin' miracle to achieve....and then when the judges that the Moses Tradition has anointed identify with only Pharaoh, you get 1999, 2000 and 2008...and Obama's continuations of the same. These were the actions of subterranean root maggots, bottom feeding Fascist shysters without a moral compass who believe that humanity has an obligation to reverse engineer itself into slime. The public is culpable for not having called their hand, sticking their own heads up their fat bottoms so far that they believed they all deserved to live in Versailles. Everyone had a moral obligation, too, and that was to have....as with the abusive leadership of Louis and Marie Antoinette in France, King George of England or Caligula in Italy…..to sharpen up the guillotine!” said Mellon.

Meanwhile, 46% of Americans even after the painful lessons of Paulson's 2008 panic attack have only $800 in their savings accounts, which is $800 more than the U.S. government has when the multi-trillion deficit is taken into account.

By J. Mustafa Farquar CPW News Services

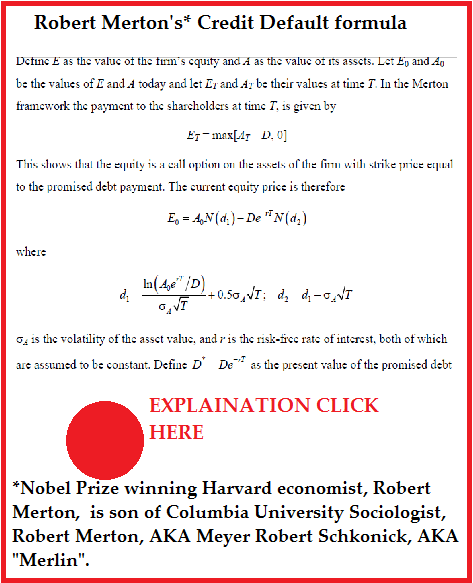

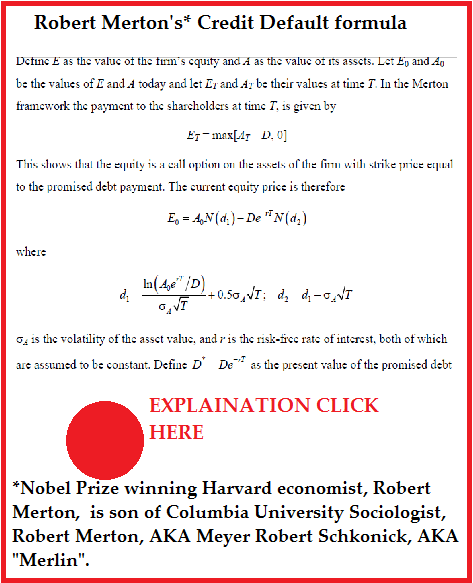

“Some Dr. Frankenstein was by the admission of Dr. Paul

Samuelson, the mentor of Nobel Prize winning Robert Merton, the Harvard economist whose father was Robert

‘Merlin’ Merton, the Sociologist from Columbia University whose cross campus nemesis

was fellow sociologist and critic of the U.S. Military Industrial Complex, C.

Wright Mills,” said Mellon referencing Peter Pezonus’ article on the ‘credit

default swap father’s’ father.

Pezonus has written:

Pezonus has written:

THE MOSES VS. JOSEPH TRADITIONS

In 2000 the election of George W. Bush provided economists Robert Merton and Myron Scholes and their complex, incomprehensible, Nobel Prize winning economic formulations and rationale for toxic asset swaps and questionable hedge fund management, a playground for economic disaster.

Sweden, the nation that is seeking to extradite Julian Assange from England so that he can be extradited to the U.S., showed its apparent love of runic riddles as well as the Merton/Scholes gnostic formulations. Sweden awarded Long Term Capital Management Inc. (LTCM), Merton's hedge fund, the Swedish Central Bank's Prize in Economics. Merton's firm lost over $1 billion in 48 hours. LTCM would be bailed out of its crisis by Henry Paulson, Alan Greenspan and the Federal Reserve using taxpayers sovereign dollars. America's Ambassador to Sweden under the Clinton and Bush administrations had been the Chief Legal Counsel to the biggest of the "too big to fail banks"... Citibank... another bailout recipient. Meanwhile, as the "too big to fail" Wall Street banking houses made off as the bandits they are, 92% of America's local banks remained solvent.

Robert Mertons' father, a sociologist and expert in Egyptology and its emphasis on pyramidal structures and mystery religion, apparently disregarded the Jewish Moses Tradition in lieu of the lesser Jewish Joseph Tradition....of throwing the brothers a few crumbs versus leading them to freedom.

Unlike Robert Merton Sr.'s only son his renegade colleague and author of The Power Elite, C. Wright Mills, proved a prophetic voice in an increasingly gilded wilderness. Mills had chronicled the typical shenanigans of those that collect their booty for supporting the beast of America's Military Industrialist Complex describing this concordat among the elites as the dominant socializing ethic in need of repair. In a way, Robert Merton Jr's. mentor, economist Paul Samuelson, validated C. Wright Mill's critique when he chided his younger protege' for providing the justification for creating the Wall Street rape of America. Paul Samuelson spoke clearly before his death of the Frankenstein monster he and fellow economics professors at MIT and Harvard had created. Unfortunately he did not shout very loudly when his nephew, Lawrence Summers, former Treasury Secretary, pushed for the repeal in 1999 of the Glass-Steagall Act, the 1933 post-Depression legislation that reigned in the Wall Street speculators. When Larry Summers, Alan Greenspan and Kenneth Lay leaned on California's Governor Gray Davis to deregulate the oil and gas industry leading to the Enron debacle and eventually to Gray Davis' recall, Uncle Paul Samuelson was as silent as a canary with laryngitis and a beak packed with peanut butter.

David Stockman, Ronald Reagan's chief economic advisor, has said of Merton's mentor, Paul Samuelson..."Paul Samuelson was not one who mourned the replacement of the 1933 Glass-Steagall by the 1999 Gramm-Leach-Biley Act."

“Pezonus had it right,” said Mellon who believes that when

the 2008 Paulson bail out occurred on the back of American taxpayers it was because

the Glass-Steagall Act had been repealed in William Jefferson Clinton’s last

year in office and just before what the Supreme Court appointed ‘the little boy with his hand in

the nation’s cookie jar and created the ‘Presidents gone wild’ freak show of

American politics from 2000-2008. This

favored son handed Obama a ghoulish economic scenario which Obama basically

continued without strings…..meaning ‘regulating strings’ attached,” said Mellon.In 2000 the election of George W. Bush provided economists Robert Merton and Myron Scholes and their complex, incomprehensible, Nobel Prize winning economic formulations and rationale for toxic asset swaps and questionable hedge fund management, a playground for economic disaster.

Sweden, the nation that is seeking to extradite Julian Assange from England so that he can be extradited to the U.S., showed its apparent love of runic riddles as well as the Merton/Scholes gnostic formulations. Sweden awarded Long Term Capital Management Inc. (LTCM), Merton's hedge fund, the Swedish Central Bank's Prize in Economics. Merton's firm lost over $1 billion in 48 hours. LTCM would be bailed out of its crisis by Henry Paulson, Alan Greenspan and the Federal Reserve using taxpayers sovereign dollars. America's Ambassador to Sweden under the Clinton and Bush administrations had been the Chief Legal Counsel to the biggest of the "too big to fail banks"... Citibank... another bailout recipient. Meanwhile, as the "too big to fail" Wall Street banking houses made off as the bandits they are, 92% of America's local banks remained solvent.

Robert Mertons' father, a sociologist and expert in Egyptology and its emphasis on pyramidal structures and mystery religion, apparently disregarded the Jewish Moses Tradition in lieu of the lesser Jewish Joseph Tradition....of throwing the brothers a few crumbs versus leading them to freedom.

Unlike Robert Merton Sr.'s only son his renegade colleague and author of The Power Elite, C. Wright Mills, proved a prophetic voice in an increasingly gilded wilderness. Mills had chronicled the typical shenanigans of those that collect their booty for supporting the beast of America's Military Industrialist Complex describing this concordat among the elites as the dominant socializing ethic in need of repair. In a way, Robert Merton Jr's. mentor, economist Paul Samuelson, validated C. Wright Mill's critique when he chided his younger protege' for providing the justification for creating the Wall Street rape of America. Paul Samuelson spoke clearly before his death of the Frankenstein monster he and fellow economics professors at MIT and Harvard had created. Unfortunately he did not shout very loudly when his nephew, Lawrence Summers, former Treasury Secretary, pushed for the repeal in 1999 of the Glass-Steagall Act, the 1933 post-Depression legislation that reigned in the Wall Street speculators. When Larry Summers, Alan Greenspan and Kenneth Lay leaned on California's Governor Gray Davis to deregulate the oil and gas industry leading to the Enron debacle and eventually to Gray Davis' recall, Uncle Paul Samuelson was as silent as a canary with laryngitis and a beak packed with peanut butter.

David Stockman, Ronald Reagan's chief economic advisor, has said of Merton's mentor, Paul Samuelson..."Paul Samuelson was not one who mourned the replacement of the 1933 Glass-Steagall by the 1999 Gramm-Leach-Biley Act."

Mellon believes that Joseph vs. the Moses analogy is a powerful one for understanding just what happened in 2008. Joseph was the servant of the Pharaoh. Moses was the reformer who democratized life with the delegation of authority and empowerment of all people. "You had in Robert 'Merlin' Merton combined with his work with Paul Lazarfeld the model for developing a Global-Gestalt....the propagandizing of the people through mass indoctrination and manipulation. In the post-World War II environment political and economic ideologies battled for control. Using focus groups and studies in bureaucracy, deviance, mass communication, the sociology of knowledge, insider and outsider perspectives and obliteration through incorporation Merton and Lazarfeld were able to arm the pharaohs of Wall Street with the resources they needed for control. As with other institutions like Stanford and the Stanford Research Institute, Merton and Lazarfeld's research was partially funded by the Central Intelligence Agency which has its start with the OSS or Office of Strategic Services which met initially at Rockefeller Center in New York. At Princeton, Lazarfeld had developed the Office of Radio Research and Lazarfeld's students became the presidents of CBS, NBC and ABC. In 1944, when Lazarfeld moved from Princeton to Columbia University where Merton would join him, the ORR was renamed the Bureau of Applied Social Research or BASR. In the 1950's and 60's Columbia became the leading university for social research. The fact that the father of this research was also the father of the credit-default instruments that tanked the U.S. economy has not been studied with any degree of seriousness. The fearless defender of American capitalism, Charlie Rose, missed the opportunity to probe this issue with a panel of Robert C. Merton and his mentor, Paul Samuelson before his death and their critics. Rose, after all, lives in New York and as Moses learned, to bite the hand of the Pharoah, can mean a long walk in the wilderness.

The most significant element of Lazarfeld and Merton's research was the power of collective amnesia, held not by the collective, but by its handlers. This was what was passed on with the repeal of Glass-Steagall. Moreover, it was the aim of John D. Rockefeller in his backing of the Oriental Institute in Chicago which had as its goal the reinstatement of historical research into Egyptian, Persian and Middle-Eastern Oriental philosophies and culture which Western Civilization had by-in-large rejected on its quest toward greater autonomy through the Renaissance, Enlightenment, Reformation and beyond. It was these important points of reference that new mind science and research methods influenced by Larsfeld, Merton and others sought to eliminate from inquiry just as had the mumbo jumbo of credit-default swaps and other Gordian nooses. New methods of academic research like 'grounded theory' were not grounded in anything that touched on historical evidence which Robert Lynd foresaw as the coming of research without a selective point of view or what he called the "ditty bag of an idiot". Focus groups were for the here and now and the short news cycle achieved in mass communication the tool for triggering the collective amnesia. Severed from its history by a mind science that rewarded the breakdown the population could be easily controlled. Academia recruited bright young minds that would betray themselves easily. Education became then, not the means to knowing how to think, but of what to think. Cut off from their history the population could more easily be convinced to make bricks with less straw, but also to chase an illusive 'American Dream' of building their own little pyramids on easy money with bigger bedrooms, more granite topped kitchen counters, sub-prime loans, bundled mortgages held by the big banks as jobs shipped to foreign countries without the inconvenience of the time-honored Western mindset. As Dave Ramsey yelled "freedom" from the 30 year mortgage, housewives and husbands saw their home as a piggy bank and refinanced it or sold it off for a step up to a newer bigger one while rationalizing that the feeling of freedom while liberating, was a distant second to the pain that burdened living under a new sub-prime mortgage rate injected into their routines. The majority of the local banks knew what was happening, but did nothing to reverse it for fear of the Federal Reserve and bam! Hello Hank Paulson!

Mellon believes that with over 90% of local banks solvent at the

time of the Henry Paulson “bail out” of Wall Street and with a shift from

paying off toxic assets by helping home owners whose mortgages were upside down

to cash infusion into the still unregulated banking system as evidenced by the

continuing rejection of a Glass-Steagall measure partitioning banking houses

from investment houses, that the money was siphoned off and is still being siphoned off.

“Yep, it was siphoned off like a bandit sucking gasoline

right out of your fuel tank. Now, with claims that jobs are on the rise the bandits at the Federal Reserve want the banks to kick up interest rates to spur the housing market. That's not really out of buyer's growing confidence and embrace of a stronger economy, but out of continuing banker's greed and their using fear that the rates will go up even higher to make more ill-gotten gains. It's salt in the still open wound. It's another shell game stimulated by fear and intimidation, a carnival hawker's well-known strategy. The big

banks were first in line with only one bank providing some level of apparent moral responsibility….Bank

of America. I said ‘apparent’. Bank of America has its roots like Transamerica Co. in the shady Vatican Bank. Bank of America actually did some of the

siphoning with Ken Lewis’ claim that his bank was solvent and didn’t need the

money, but was being forced to take it anyway and then in an action totally objectionable

under Glass-Steagall he was being forced

to acquire the investment house of Merrill Lynch, formerly Merrill Lynch Pierce

Fenner and Smith….with the Pierce being the family of Barbara Pierce Bush. It was a scene right out of Casablanca with

the French Vichy police chief decrying the shell games at Rick's Bar on the one hand, while taking

payoff money on the other. Then you have to figure that much

of the rest of the money was hidden right under our noses in plain sight. So if it didn’t go to help the home buyers

then it went somewhere else. To AIG and Paulson's long table of big banks? Yes, but a chunk to the 5-8% of the local banks that were not solvent at the time of bailout.

I would look to small mortgage companies that held large tracks of undeveloped or under-developed properties as the real estate market tanked, then claimed in bankruptcy that it was worth far more than it was while sympathetic bankruptcy judges decided in their favor. In the months before Paulson's TARP announcement I'd look for those judges taking what appears to be some high profile stance against the corruption they secretly embrace. Perhaps a district-wide letter to bankruptcy attorneys with warnings against bamboozling the legal system. That may sound like conspiratorial paranoia, but must I remind you that Tammany Hall included thousands of conspirators as have other national scandals including the Savings and Loan scandal of the 80's. With many, many more of these threatened, but solvent, local banks than the 'too big to fail' monsters standing in line, where did the TARP money go? Was the

money hidden within the mushy local real

estate markets with evaluations in the bankruptcy court decisions yielding a huge profit with the money being hot wired to secret

accounts in the Caymans, given out in unjustifiable executive compensation as when Bank of America acquired Merrill Lynch. There is reason to believe that Western Bank in Texas was declared by court order 'bankrupt' when it was not and the money vanished. With renewed confidence stimulated by the TARP money the bank stocks went up. Amazingly the stock market climbs while the national debt is through the roof....no through the stratosphere! This gave justification for a rise in bank stocks which in turn was used to repay TARP, but from whose money the bamboozled public, again? The little investors who couldn't pay their mortgages?” said Mellon noting a continuation in the Hank Paulson bailout of the earlier 1980's Savings and Loan scandal and the upward redistribution of U.S. wealth which has been well chronicled. "I can imagine that many of these failing local banks partnered together in what under Glass-Steagall would have been a crime, took the TARP money, then saw their stock price go up, perhaps saying like Ken Lewis that they didn't need it and gave the money back just as they were laundering it like a Chinese steam cleaner, then finding new investors jumping in with money from who knows where and life is a cabaret!" said Mellon. "The bankers see it like a surgeon sees the systolic and diastolic pumping action of the human heart. As long as its pumping in Boston or San Francisco, Chicago, New York or Houston, Dallas and Miami, who cares if the blood flows through a few backwater war-torn nations where innocents are killed in collateral damage, or as sociologist father of Robert Merton, also Robert Merton, coined....'unintended consequences'?" asked Mellon. "Unintended? Huh!" Mellon blurted.

Mellon's eyes were glazed. “Dr. Paul Samuelson’s assessment of the rape by the Frankenstein monster he had a hand in creating was not strong enough. When the Moses Tradition is jettisoned for the Joseph Tradition....forget the damn Jesus Tradition....that would take a friggin' miracle to achieve....and then when the judges that the Moses Tradition has anointed identify with only Pharaoh, you get 1999, 2000 and 2008...and Obama's continuations of the same. These were the actions of subterranean root maggots, bottom feeding Fascist shysters without a moral compass who believe that humanity has an obligation to reverse engineer itself into slime. The public is culpable for not having called their hand, sticking their own heads up their fat bottoms so far that they believed they all deserved to live in Versailles. Everyone had a moral obligation, too, and that was to have....as with the abusive leadership of Louis and Marie Antoinette in France, King George of England or Caligula in Italy…..to sharpen up the guillotine!” said Mellon.

Meanwhile, 46% of Americans even after the painful lessons of Paulson's 2008 panic attack have only $800 in their savings accounts, which is $800 more than the U.S. government has when the multi-trillion deficit is taken into account.

No comments:

Post a Comment